In our last post, we discussed about central banks, if you haven’t read it yet, here it is: What are Central Banks. To finish the chain of thought about money and how the supply is managed by central banks, we need to understand one more crucial piece to the puzzle, how do commercial banks (that you have savings/checking accounts with) help facilitate the policy goals of central banks on increasing and decreasing the money supply in the economy. Let’s look at how exactly does a bank conduct it’s activity using the depositor money.

Let’s suppose you open a new account with a large commercial bank like Bank of America, J.P. Morgan, Wells Fargo etc. and deposited $10000 worth of your savings. You must have noticed the savings rate the bank has offered, probably nothing!

THE BANKING MACHINE:

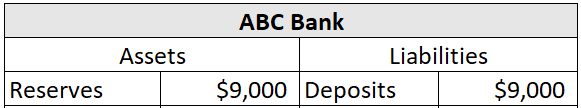

Most banks make huge profits by accepting customer deposits and making loans using that money. Let’s use the simple case of 100% reserve banking where all deposits are held as reserves

But as per the regulatory rules, banks don’t need to hold all the deposits as reserves in the current system i.e. with the central bank. Bank reserves are the cash minimums that financial institutions must have on hand in order to meet central bank requirements (remember central banks are the lender of last resort to these banks if there is financial trouble). They will need to hold only a fraction of it set by the reserve ratio. The reserve ratio is specified by the Federal Reserve Board's Regulation D. Regulation D created a set of uniform reserve requirements and requires banks to provide regular reports to the Federal Reserve.

Let’s say reserve ratio is 10%. Banks can then lend the rest of 90% back as loans, thereby increasing the money supply.

Let’s assume the 90% of the deposit was lent out to other bank ABC Bank, whose balance sheet will look something like this:

ABC bank can then use that for lending again to another bank, whilst having a 10% reserve. Thereby, the lending 90% of the deposit to other third bank DEF Bank. Now DEF bank repeat the same process and lend 90% of that money it borrowed from ABC bank to next bank.

If you look back, we started with $10,000 deposit it was lent out again and again by different banks to create more loans while keeping 10% in reserves, and as you extend this process many time over, you will notice that banks create 5x or 6x times the initial deposit as credit. This credit helps promote economic activity and as borrowers use the credit to build businesses, invest in assets, buy goods and produce services.

Banks hold a fraction of the money deposited as reserves and lend out the rest to make their profit. They profit because they tend to offer low rates to depositors and high rates to borrowers who take the loan and pay them interest every month for a long time. The difference between the average interest a bank earns on its assets and the average interest rate paid on its liabilities (deposits) is termed the spread. Just sign-in to your bank account and check how much savings interest your bank has given you over the past year, don’t keep high expectations!

HOW DO YOU CONNECT THE DOTS:

When the central bank, using the monetary policy (we discussed in our last post), increases lending rates to the banking system which in turn forces banks to increase the interest rate on lending to maintain spreads. This leads to a reduction in the demand for loans as less borrowers will be willing to take on loans at higher rates. Less loans mean less credit flow into the economy, the $10,000 deposit in the bank only produces 2x or 3x more credit rather than the 5x or 6x times when rates are low.

Reversely, a reduction in interest rates would be expected to stimulate the demand for loans, thereby fueling more credit in the economy, thereby stimulating the economic back to growth. Currently we are seeing interest rates at the highest levels in the past 40 years. This has inherently creating lower lending activity for banks, who originate lesser loans as demand falls, and tighter economic conditions for borrowers. How long will this persist? That’s the key question as higher rates for a long period of time can cause some serious damage to economic conditions, due to the disruption of free flow of credit. Credit is the backbone of the economic engine, the engine doesn’t function without a backbone for a long time!

REMEMBER BANKS EXISTS TO GENERATE PROFIT FOR SHAREHOLDERS and by doing so they indirectly helps central banks to regulate economic activity using the monetary policies. Think of money as a commodity and the commodity is under the ownership of central bank who works closely with it’s trusted partners (like big banks) to distribute the commodity to borrowers in the economy. Once you get this framework in your head, financial assets becomes much easier to analyze.

BANKING RISKS:

So far we have talked about the activity of banks and how they make profits using customer deposits. Let’s also focus a bit on the risks that banks have to manage well because economy needs banks to survive to provide credit for borrowers. Banks can only survive if they follow sound risk management and governance principles. Case in point: Silicon Value Bank!

Below are some of the key risks to a bank business, there are plenty more than the ones described below:

•Systemic risk refers to the risk of failure across the whole of the financial sector rather than just to one or two institutions. This is related to factors outside a single entity. Systemic risk is what is protected by central bank by acting as lender of last resort for all banks if they are in trouble. That’s the unseen power of central banks! You don’t see it but it’s all around you. Credit can’t stop flowing into the economy.

•Interest rate risk refers to the risk to earnings or capital arising from movements in interest rates. When banks borrow at low rates in short-term and lend it out at higher rates for long-term loans, the earnings come from the spread. But when banks borrow short-term at higher rates and unable to lend as much at much higher rates in the long run. The Spread narrows and the volume of loans goes lower too.

•Credit risk is the risk banks take in making loans that borrowers will default. This is related to single entity and require risk management in-house to manage it. Credit risk is similar to assessing the health of the balance sheet of a firm and it’s ability to pay interests on it’s loans.

•Liquidity risk Liquidity risk is the risk to earnings or capital arising from a bank's inability to meet its obligations when they come due, without incurring unacceptable losses. Liquidity risk includes the inability to manage unplanned decreases or changes in funding sources.

There are many other types of risks the banks deal with like operational, vendor, counterparty etc. Banks constantly need to manage risks of their balance sheet to continue to operate normally. Having covered the banking model and how economies function due to interest rates, let’s talk a bit about the most topical subject on everyone’s mind right now, Inflation!

WHAT IS INFLATION?

Inflation is simply a function of the imbalance of demand and supply of goods in the economy. When you have too much money in the system (economy) and that money is chasing to buy goods that limited and unable to match the demand, we naturally get a increase in prices of the goods. This increase in price results is what we call inflation in simple terms. There is a lot of financial jargon around what causes inflation but in it’s simplest form, inflation is a result of too much money chasing fewer goods and services. Why is inflation important to understand? Here’s why:

Nominal interest rates are what people see everyday as published by banks and other institutes. For example, when a bank says that you will earn 6% on savings deposits, they are talking about the nominal interest rate. On the other hand, real interest rates take purchasing power into consideration. That’s the rate, which tells how much more you will be able to buy with your grown investment after one year.

Example, assume a bank is offering you an interest rate of 5% on your deposits and the expected inflation is 3%, then the real interest rate you earn at the end is just 2% keeping the inflation in mind. In terms of real value of money, your investment will grow only by 2%.

If you deposit $100 at the beginning of the year, your deposit will grow to $105 by the end of the year. However, at the end of the year if you buy a good that has appreciated due to inflation, your $105 will not buy you 5% more stuff. It will buy you only 2% more stuff every year (Amount Column).

Real Interest Rate = Nominal Interest – Inflation Rate

Let’s suppose if the inflation is 7% and interest rate offered is 5%, now at the end of the year you will have $105 in the bank account but it will be only enough 98% of the goods now because inflation was around 7%. Now the $105 at the end of the year, buys you 2% less of the goods.

This is the hidden problem with inflation that everyone feels over time. If the prices of good and assets are increasing, then you will be purchasing less and less of them every year if inflation continues to persist (as shown below with the orange line).

This is why inflation is an important monetary concept to comprehend. It affects almost every asset class and every consumer in the way they spend. As prices of goods keep increasing, consumer adapt their spending habits and reduce their spending on items they want (beyond what they need).

WHAT CAUSES INFLATIONS?

Inflation is caused as we increase the supply of money or credit in the economy through loose monetary policies. Assume interest rates are at 1%, borrowing at 1% is a very easy decision for many borrowers and hence one can expect large volumes of loans being issued by lenders at 1%. Now that money that’s lent out is circulating in the economy to buy goods, services, invest etc. thereby increasing the demand for them products and services. Naturally, production of goods involves many moving parts from buying raw materials, transporting, manufacturing and distributing into the consumer market. There is opportunity for lot of areas of inefficiency in the loop that can create problems. Hence, if the production of these goods is unable to keep up with the demand, we tend to get an imbalance of supply demand equation. When there is imbalance (like the below chart) we tend to get an change in equilibrium price. Equilibrium price is the price at which both demand and supply curve intersect. This gives an indication of the best price one can charge to keep the market stable.

The price and quantity of goods and services in the marketplace are largely determined by consumer demand and the amount that suppliers are willing to supply. Demand and supply can be plotted as curves. The point at which the two curves meet is known as the market quantity supplied. The market tends to naturally move toward this equilibrium – and when total demand and total supply shift, the equilibrium moves accordingly. If you are wondering why the supply curve is upward sloping, that’s because only certain low cost producers can supply goods at low prices, as prices go higher other high cost producers can also make a profit by supplying the good. Eventually, the prices go higher, everyone makes a profit and more supply (ignoring the demand equation).

Inflation by itself is not a bad thing, in fact moderate inflation can be healthy for the economy as it restores balance of credit in the economy. But high inflation can be damaging to the economy if it persists for a long time. As inflation persists for many years, the prices of goods could be go up 20-30% within a span of two years and thereby affecting the psychology of the consumer of how much to spend and not to spend. As consumers spend less, the companies will produce less and invest less because their profits are less. If the investment into the economy is less, it tends to create more unemployment as their is no demand for new jobs. This is a spiral downwards if inflation continues to be stay out of control for long periods of period.

The extreme case of such scenario would be termed as Hyperinflation! My next post will be about hyperinflation and some historical cases observed in certain countries. As a thought experiment, when you get a chance, do check the prices of eggs for the past three years!

Stay tuned for more!