By the end of my last post on banking, we discussed about inflation and what causes it (using a simple analogy). Broadly speaking, inflation is caused by too much money chasing too few goods, caused by the imbalance of supply-demand dynamics. Hence naturally, the price of the good keeps going higher as more and more money chases it. As consumers spend more and more money consuming excess, the inflation problem persists longer. In this post, let’s deep dive into the problem of inflation and look into the historical events for reference. Understanding historical methods is very crucial because policymakers more often than not refer to the old ways for dealing with monetary problems.

Controlling inflation and providing price stability is one of the key mandates for central banks, we have already looked into some the monetary policies they could pursue to achieve this in the post here. Keeping price stability is important because it reduces the uncertainty of raising costs for producing goods and services. Thereby, the demand for the goods can be forecasted better and firms can deploy working capital accordingly to hire more employers, buy equipment and generate more economic activity. As prices rise, the cost of goods and labor rises as well, but if the demand for the goods produced doesn’t keep up with prices, the firms will scale back on their spending and start cutting jobs to prepare for lower demand. Always remembers, a for-profit corporations exists to MAKE PROFITS doing business, keeping employees on the payroll and accepting high costs is not their agenda.

How is Inflation Measured:

Inflation in US is measured mainly using two index: the Consumer Price Index (CPI) and the Personal Consumption Expenditures Index (PCE). The CPI is released by the Bureau of Labor Statistics (see here for details and the latest release), and the PCE is issued by the Bureau of Economic Analysis (here for details).

While both measure inflation based on a basket of goods, there are subtle differences between the indices:

Data Source: The CPI uses data from household surveys; the PCE uses data from the gross domestic product report and from suppliers. In addition, the PCE measures goods and services bought by all U.S. households and nonprofits. The CPI only accounts for all urban households.

Coverage: The CPI only covers out-of-pocket expenditures on goods and services purchased. It excludes other expenditures that are not paid for directly (e.g., medical care paid for by employer-provided insurance, Medicare, or Medicaid). These are included in the PCE.

Formulas: The PCE calculations are done without categories that display wild price swings like gasoline that are included in CPI. Hence, PCE is less volatile than the CPI.

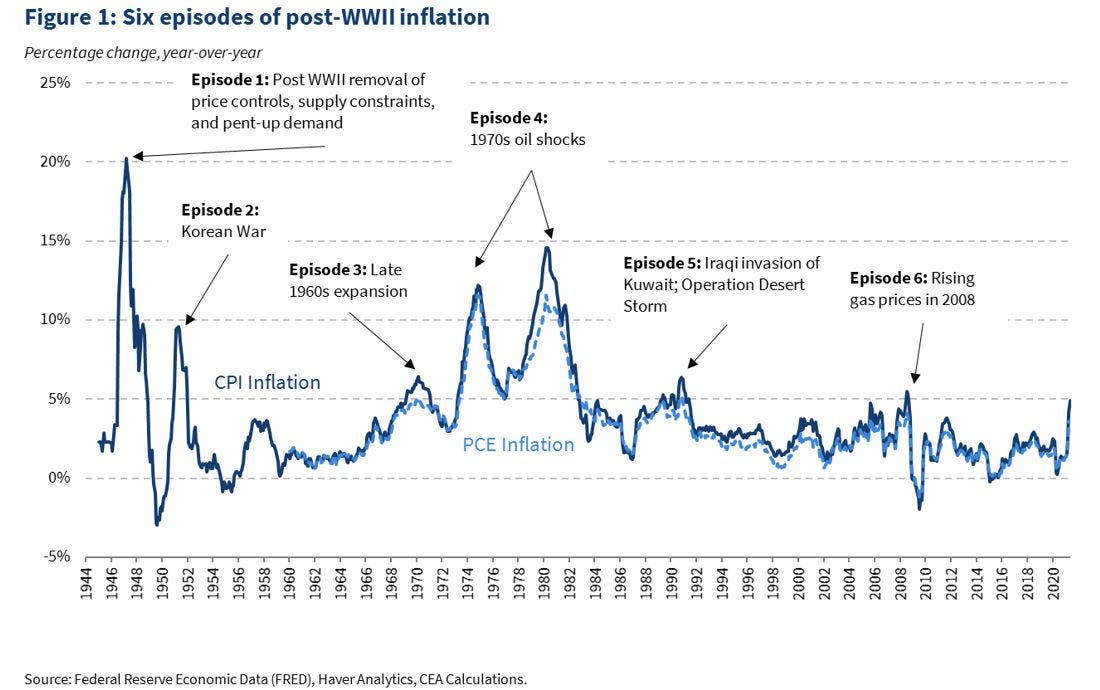

Below is historical chart showing how CPI and PCE track closely to each other, due to subtle differences.

Why is Inflation Bad?

Inflation by itself needs to be understood in the context of time frame, high inflation for 6 months is not the same thing as high inflation for 3 years. Both of them have different impact on the economy and consumer psychology. Let’s try to think about inflation from the perspective of various parties in the economy:

Consumer: As a consumer, you prefer to want more for less. Of-course, there are some things that you’re willing to pay more to get less depending on how badly you need it. As prices go higher with inflation, consumers will start feeling lighter in the pocket as more money is getting spent on acquiring less. This feeling leads to reduction of spending (or adjustment rather) on things they want to buy (luxury, travel) to maintain spending on things they need to buy (household items). Again, not all consumers have the same spending capacity, but majority of the consumers don’t belong to the very rich category!

Corporations: For corporations, inflation impact affects both the revenue and costs. The costs is simply because the cost of labor, new hires, new equipment all go up. Hence, depending on the demand for the products they sell, corporations tend to cut costs to preserve the profit margin for all as long as possible. Few firms can afford to pass on the extra costs to the consumers and still maintain the profit margins but it depends how long the demand lasts for the products. Based on how long inflation persists, one can expect much lower demand for certain products and services. On the revenue side, as inflations rises the cost of goods and services, consumers tend to cut back spending and budget their needs. This inherently results in lower demand for goods and lower revenue for the firms selling it. Do note that, the bottom line impact for most firms is expected to be lower profits but there are firms that produce key essential services that consumers will still end-up paying higher price no matter. For example, consumers will continue to spend on gas, electricity, food supplies, perhaps certain subscriptions they can’t live without.

Investors: From a investor standpoint, inflation is very hurtful if you are holding fixed maturity assets that are locked in to pay a certain interest rate. That’s because even though the money is eventually paid over time, the purchasing power of that money diminishes drastically as inflation persists longer (refer to banking post for case study). But for investors putting money in other asset classes like equity, real estate etc. one can still find opportunities to make good bets, given one is good with selecting corporations that will be able to preserve or increase their profit margin even during high inflation. But overall, inflation can be a tricky environment to navigate for many seasoned investors as it’s hard to predict how long the inflation persists and how much demand will be destroyed.

Central Banks: If you read read my other post on central banks, we discussed that one of the two mandate for central bank is Stable prices, meaning low stable inflation. Hence, inflation is a huge problem for central banks if it goes out of control, which breeds price instability and dent in consumer demand for products and services. Central Banks need to curb inflation as early as possible because it persists for longer, it can lead to some very serious consequences for the economy. Central bank work to stabilize inflation is by increasing interest rates to curb economic activity by reducing the money flow in the system (lower lending by banks). This results in lower investments and lower economic growth. As growth falters, we will have cost cutting by corporations and businesses, that results in unemployment. As unemployment rises, the demand to spend on products and services curbs down. As the supply and demand changes, the equilibrium prices falls back to lower levels, thereby helping achieve the lower stable prices again.

As you can see, the central back activity has massive implications to what goes on in the economy. Today, as the inflation over the past year has spiked to record levels (in the last 40 years), central bank raised the interest rates to very high level to tackle it. This is the reason, the cost of capital for many firms has gone up drastically and the demand for their products and services has been impacted. Hence, firms have enacted cost cutting measures i.e. firm wide lay-offs, nuking low convictive products etc. How long will this last? As long as it takes to curb inflation back to stable low levels! That’s the message from the central bank, not me!

History of Inflation:

Over the history, we have had several instances of high inflation in US and other countries. Below timeline chart shows six periods from 1940s onwards, that have shown high inflation episodes.

The three most recent inflationary episodes were largely a function of oil shocks; in contrast, the recent Covid-2020 induced inflation is due to supply chain disruption. The episode from 1969–71 is also different because the economy was growing at nearly 5 percent per year for half a decade. The episode during the Korean War is a closer comparison, as households rushed to buy goods in anticipation of a supply shortage. While households are consuming more today in the aftermath of COVID due to pent-up demand, they are not hoarding in anticipation of supply shortage.

During COVID, businesses were shut down and households mostly stayed indoors. Expenditures on entertainment, dining at restaurants, and travel fell dramatically and personal savings increased during the pandemic as well, and now as the pent-up demand was unleashed and supply chains still not recovered fully, we are seeing inflationary pressures in the economy. As supply chain recovers back to normal, we should expect to see the inflation levels decline as supply-demand equation falls back into balance.

What is Hyperinflation:

So far we spoke about inflation and prices increasing slowly over time. But what if I told you prices can increase notably every day? That’s when the economy is experiencing Hyperinflation. Hyperinflation is a term to describe rapid, excessive, and out-of-control general price increases in an economy. The conventional marker for hyperinflation is 50% per month. Hyperinflation is mostly consequence of government ineptitude and fiscal irresponsibility, that leads to compounding of economic missteps over the years and results in disruption of supply-chains, productions lines, economic deficit growing and currency devaluation.

Although hyperinflation is a rare event for developed economies, it has occurred many times throughout history in countries such as China, Germany, Russia, Hungary, and Georgia. Quite recently we have witness rapid inflation in Venezuela and Argentina.

Venezuela Hyperinflation:

Venezuela is reported the country with the largest oil reserves in the world, a nation rich with resource that world depends on, yet the country has been economic decline for the past four decades. The causes behind Venezuela’s collapse are complex and have been attributed to years of poor governance, political corruption, and misguided economic policies.

The crisis accelerated in 2014, coinciding with falling global oil prices and the election of President Nicolás Maduro following the death of Hugo Chávez. The fall in oil prices helped trigger a recession and runaway inflation, which continue today. Venezuela’s economic decline has led to a devastating decrease in household purchasing power, food and medicine shortages, and the mass emigration of millions of Venezuelans.

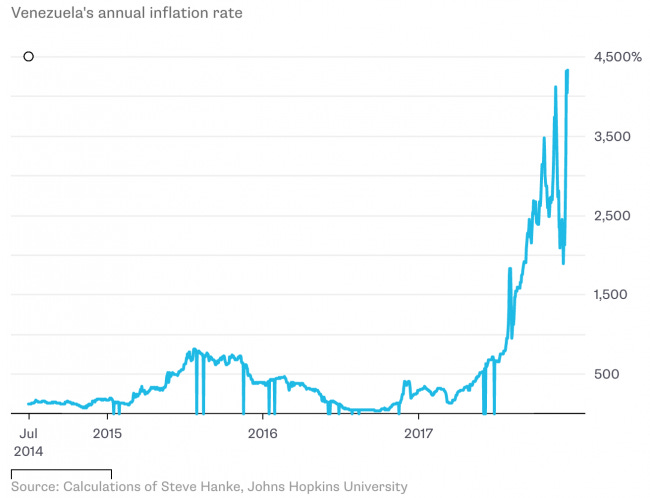

Hyperinflation has rendered Venezuela’s currency nearly worthless. Inflation has exceeded 100% each year since 2015, peaking at over 65,000% in 2018. In 2018, Venezuela’s currency, the Bolívar Fuerte (VEF), was replaced with a new currency, the Bolívar Soberano (VES). The currency replacement attempted to address Venezuela’s currency instability by cutting five zeros off the old currency. Below is the chart displaying the annual inflation rate

Argentina Hyperinflation:

Argentina has also been experiencing very high inflation numbers since the start of 2021. It was reported to have triple-digit inflation number at the start of 2023. Again, causes of inflation are multiple, including persistent deficit spending, constant devaluation and external factors like the war in Ukraine that affected energy and grain prices.

Annual inflation has been above 50% most of the time since 2018 after a economic crisis. Inflation’s impact has been exacerbated by three years of recession — since the 1950s, Argentina has spent more time in recession than almost any other nation, according to the World Bank. Still, today’s price gains remain far from the heights reached in the country’s last bout of hyperinflation from 1989 to 1991, when it surpassed 3,000% annually.

A currency crisis in 2018 led to the peso losing half of its value against the dollar. The IMF responded by loaning a record $57 billion to the business-friendly administration led by then-President, but the deal failed to stabilize the economy and led the government to defaulted on the debt. Without access to credit following the default, government printed money during the pandemic to finance cash handouts and salary programs, which set the stage for inflation to surge higher. The president also implemented currency controls and price freezes, creating an many different exchange rates. The measures proved ineffective at cooling inflation and currency losses, but made the business environment more complex for companies across the country.

Now, Argentina is on the brink of another recession this year as a historic drought comes on top of inflation. Inflation in triple-digit territory is wiping out Argentines’ paychecks, shrinking their buying power and consumer spending. The drought is destroying Argentina’s key commodity exports — soy, corn and wheat — that are essential to growth, jobs and tax revenue. Argentina’s top grains exchange forecasts a soy harvest of only 25 million metric tons compared with the five-year average of 45 million tons. The solution to tackling the inflation problem still proves elusive.

Below is the chart showing the annual inflation rate in Argentina.

Conclusion:

As you have gleaned over the past few posts, inflation is very hard problem to solve if it goes out of control. It is typically caused by the imbalance of supply-demand equation for goods, combined with excess money chasing too few goods, resulting in price increases for consumers. As consumer demand wanes or supply gets fixed, inflation is expected to come back to a more steady state.

Central banks have a very important role to play in tackling inflation. They enact monetary policy changes to curb inflation as soon as possible because of the long term consequences of prolonged high inflation in the economy. This is why we are not witnessing high interest rates set by the central bank in US to help tackle the inflation problem quickly. Unfortunately, such actions are resulting in reduced demand for lending and cost-cutting measures by firms to prepare for a slowing economic growth ahead.

Inflation has been at very high levels many times in the past, affecting some countries much more than the other. Developing/Emerging countries are much more vulnerable to high inflation due to lack of policy enactment and government mismanagement. Developed countries have better tools to manage inflation issues but however they can also end up with rampant high inflation unless proper measures are not taken to curb it quickly!